- 71% of respondents trust their bank to secure personal data, with a majority also confident in healthcare providers and legal services

- Business size does not affect the likelihood of changing providers after a data breach, with similar proportions willing to switch from both small and large service providers

Boston, London, 29th April 2024—New research from CybSafe, the human risk management platform, has found consumers trust the banking sector most when it comes to protecting sensitive data.

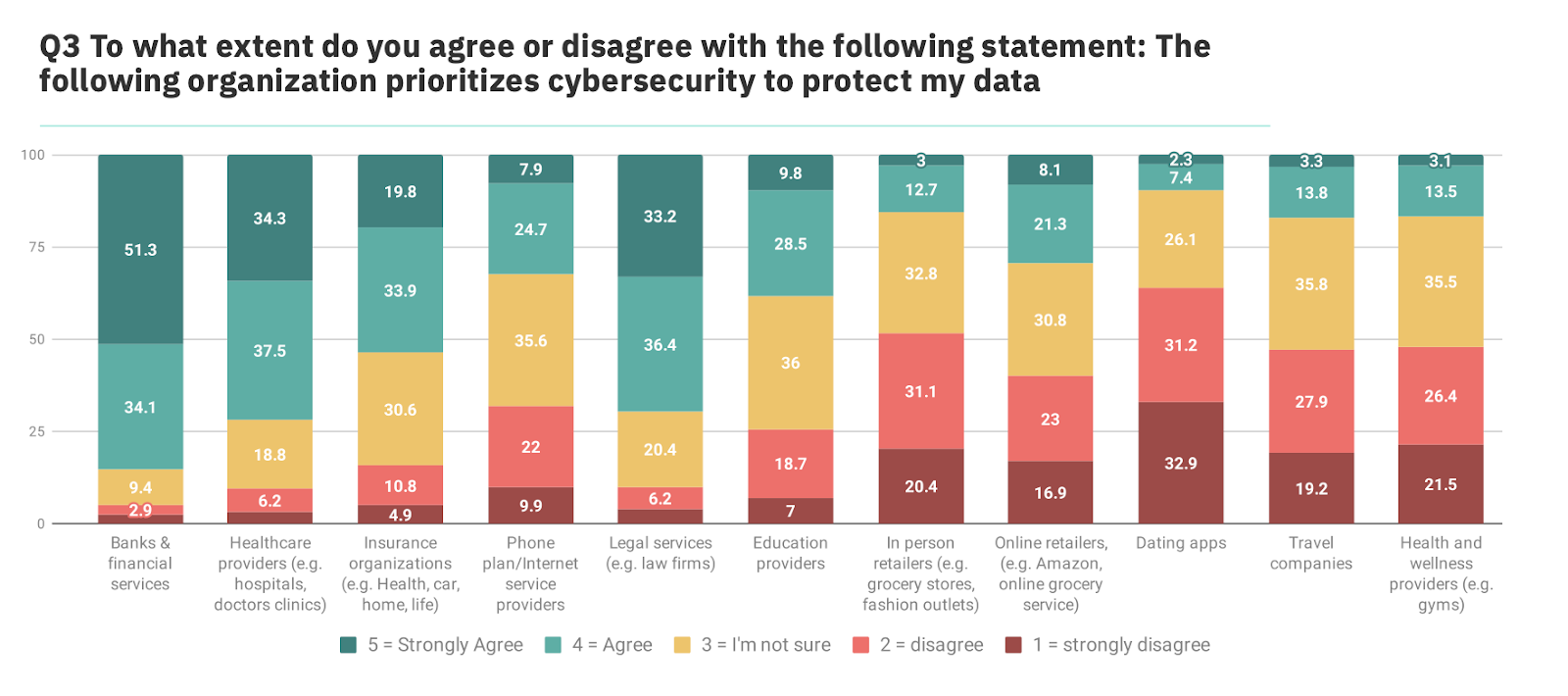

The study, which asked 1,000 consumers across the UK and the US about the impact of organizations’ cybersecurity policies on their decisions and opinions as customers, highlighted a majority of respondents were confident in the abilities of the banking (71%), healthcare (61%), and legal sectors (69%). In-person retailers (16%), dating apps (8%), health and wellness providers like gyms (17%), and travel companies (18%) failed to gain consumers’ confidence in similar numbers.

Consumers are increasingly prioritizing cybersecurity as a key factor in their decision-making processes, reflecting growing concerns about data protection and privacy. As a result, organizations are facing heightened scrutiny regarding their cybersecurity policies.

Do customers think their service providers prioritize cybersecurity?

When customers were surveyed on whether they believed certain sectors prioritized cybersecurity to protect their data, the results were similar. Banks (85%), healthcare (71%), legal services (70%), and insurance providers (54%) were viewed favorably. On the other hand, the same industries, along with phone plan and internet service providers, ranked lowest, with only a third of respondents feeling that their data was a priority for their service provider.

Customers believe online retailers prioritized their data twice as much compared to brick-and-mortar shops such as grocery stores and fashion outlets. The data indicates traditional providers need to significantly enhance their reputation for maintaining customer security.

Business size has little impact on customer behavior following a data breach

Businesses of all sizes experience data breaches and are required to notify customers when these occur. Although larger companies often receive more media attention, research indicates customers are equally likely to switch providers, regardless of the size, if a breach happens. Specifically, 29% of respondents said they would be more likely to change providers if a large organization suffered a breach, compared to 26% who would do the same with a smaller organization. Notably, 34% stated they would switch providers in either scenario, while 12% would stay with their current service provider regardless of a breach.

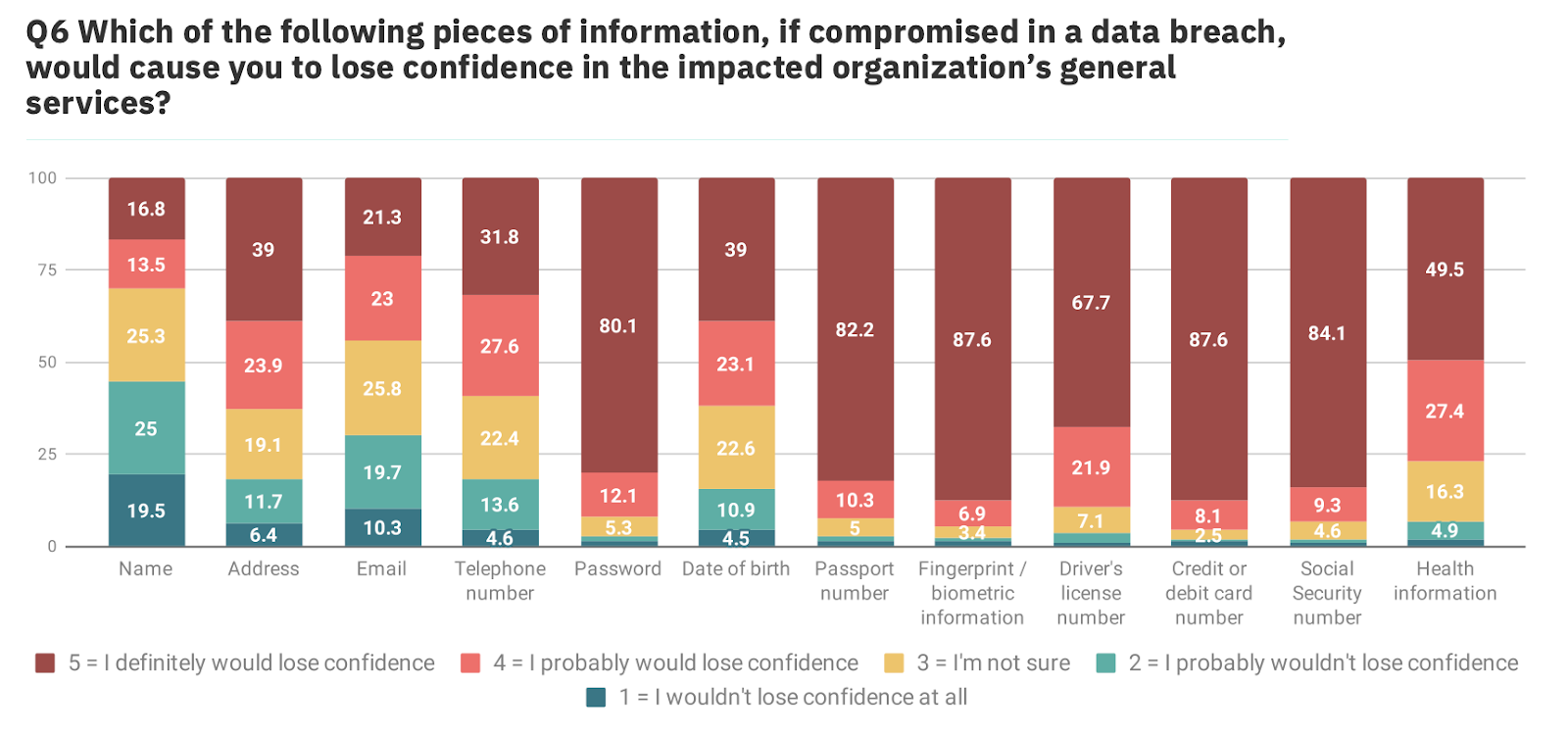

Some data is more important to customers

Another crucial aspect of cybersecurity is the nature of the data held by service providers and the impact its loss has on consumer confidence.

The majority of respondents indicated they would lose confidence in an organization’s general services if a data breach resulted in cybercriminals accessing sensitive information such as fingerprint/biometric data (95%), credit/debit card details (96%), social security/national insurance numbers (94%), passport numbers (93%), or passwords (92%). Data considered less critical, such as addresses (63%), emails (44%), dates of birth (62%), phone numbers (59%), and names (30%), had a lesser impact on consumer confidence in general services.

Reacting to the research, Oz Alashe MBE, CEO of CybSafe, said: “Consumer expectations surrounding cybersecurity readiness at service organizations are changing. While customers feel financial institutions, legal services and healthcare providers are generally doing a good job of prioritizing security, there is a growing demand for all industries to move beyond compliance towards a more holistic approach.”

“This research gives important insights into shifting consumer behaviors, emphasizing how customers want to feel empowered through their provider to confidently navigate the digital age. Cybersecurity in banking is no longer just about protection. For an increasing number of customers, it’s a market differentiator.”

To read the full report looking into how cybersecurity policy is impacting customer expectations and behaviors, visit: www.cybsafe.com/press/banking-on-trust-how-consumer-banking-behavior-is-swayed-by-security

-END-

About CybSafe

CybSafe is the human risk management platform designed to reduce human cyber risk in the modern, remote, and hybrid work environment, by measuring and influencing specific security behaviors.

CybSafe is powered by SebDB—the world’s most comprehensive security behaviors database—and built by the industry’s largest in-house team of psychologists, behavioral scientists, analysts, and security experts. An award-winning, fully scalable, and customizable solution, it’s the smart choice for any organization.

- 91% Reduction in high-risk phishing behavior

- 55% Improvement in security behaviors

- 4x More likely to engage in cybersecurity initiatives

Press contact

Resonance

+44 208 819 3170